-

Credit Card

So far…

When @_sodabottle taught me the basics of personal finance, one thing he said was, “Credit Card and EMI are like the swear words of financial dictionary. We should be at least 10 miles away from where those words are uttered”. I think the advice is one of the best for a person who is about to get his first salary and learning about saving. It inculcated a mentality where I always saved the money required to buying anything.

What changed..

.. this year, is that, I was finding it hard to balance the irregularity of a freelancer’s income and the regularity of monthly bills. The transfers would get delayed anywhere between 3 day to 3 weeks. Credit cards solved that for me by giving interest free credit for upto 30 days. I spend on the credit card, takeout cash on the Debit card. There is always enough buffer in the bank account so I don’t stress about not having sufficient balance for my SIP payments.

What I learnt? Never do cash withdrawals with Credit Card as interest calculation starts from the day you withdraw cash. 30 day interest free credit is only for payments. So,

Payments - Credit Card Cash - Debit Card

Another bonus of having credit card for payments is that, it shows a healthy bank statement, comes in handy when applying for VISAs to travel abroad.

-

Interest Rates & Gilt Mutual Funds

One of my biggest learning this year was how interest rates, bonds and yields work. I am happy that I converted it into actionable investment strategy.

Disclaimer: Don’t take this as investment advice. I won’t be responsible for unsatisfactory results. I am keeping things vague purposefully so you will read, understand and apply.

Basics

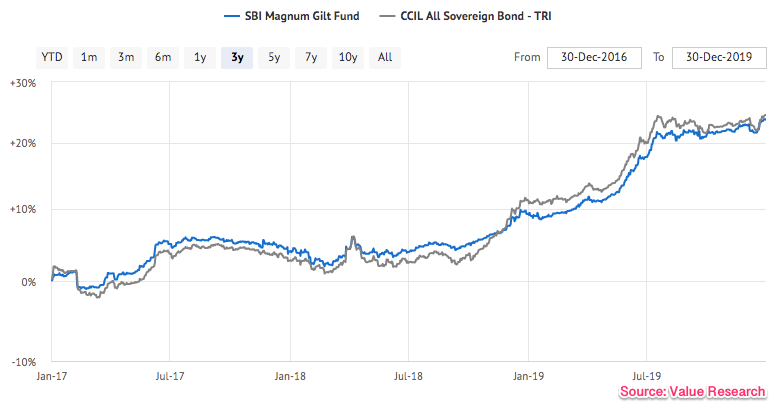

Gilt Mutual Funds are mutual funds that buy Government Bonds with the money we put in them. Govt bonds are the safest way to invest money because governments don’t default that easily (except in rare cases, look up Sovereign Default, it is an interesting topic). But Gilt funds are not. This is because Bonds are traded. So the value of the bond might go up or down based on a lot of things. This is usually tracked by a value called GSec 10 Yr Bond Yield. When the yield is high the price of the bonds are low and vice versa.

What I learnt…

Because of this the value of the bond might go up or down. If you invest during the wrong time you might get less than what you put in. So, when is the right time?

My thumb rule is - invest when 10 Yr GSec yields spike more than Bank Deposit rates.

I did a simple graph based analysis in this post Investing in GILT funds. Doesn’t explain much, but if you know what are yields, repo rates and read the comments on the graphs you will get an idea of how to time your investment.

-

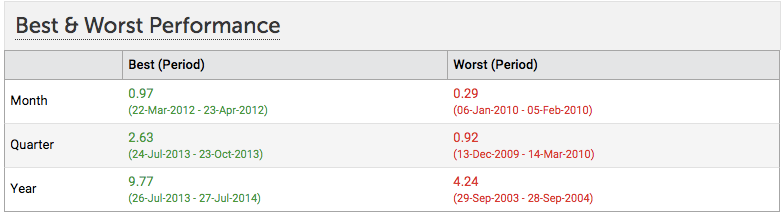

Liquid Funds

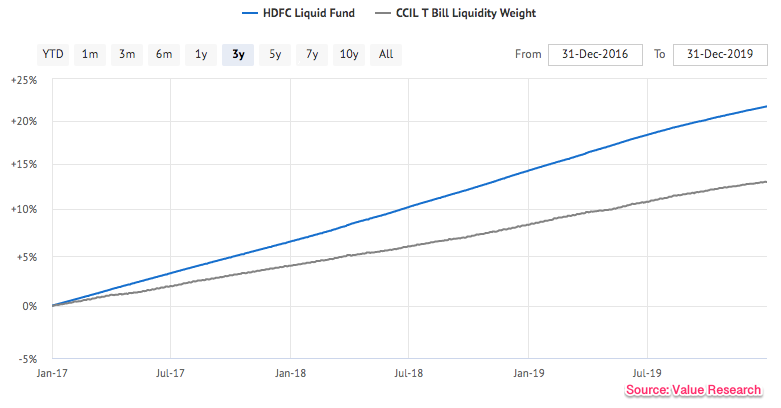

In 2018 I moved from Bank Deposits to Liquid Funds. Liquid funds use the money we give in short term debt bonds called “commercial papers”, which is a technical name for bonds which mature in 3 months - 6 months..etc,. Maturity is basically the borrower paying back the sum borrowed with interest. Due to their short term nature they are usually very safe and there is almost never at risk of negative returns.

Notice how the returns is almost a straight line going up.

What I learnt..

The returns vary in relation to Repo Rates. While I get a constant rate in a bank deposit, this allows me to get better rates when repo rates raise. Of course there will be times when it under performs as well.

Despite a small risk of getting poorer returns than fixed deposit why I prefer Liquid funds:

- The risk is actually very small. Most times the returns are similar to bank deposits

- There is no maturity period involved. What that means is I get whatever interest has accumulated on the day of withdrawal, unlike a fixed deposit where I have to forgo the interest if I break the FD before maturity.

- I have the flexibility deposit any amount and withdraw any amount at any time. Setup an SIP, this becomes a Recurring Deposit.

- If I happen to never need this fund and it sits for more than 3 years, then I get indexation benefit. That means, I pay tax on not for the full interest, but for the interest earned after adjusting for inflation.

- There is no TDS involved as in bank deposits. And Tax calculation itself is advantageous when doing partial withdrawals as everything is measured in units. See this post on how this calculation works.

- Some Liquid funds offer same day withdrawal upto 50,000 and full withdrawal in 24 hours. Comes real handy as an emergency fund. So there is never this worry of putting in redemption request and waiting.

I have kind of taken advantage of Liquid Funds to the fullest this year and would continue to use it.

-

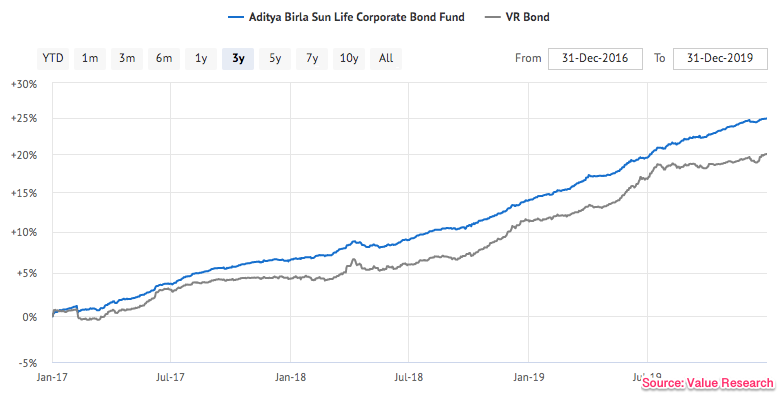

Corporate Bonds & Funds

While I am big fan of Liquid funds, the Corporate Bond Funds is another debt fund that which focuses on corporate bonds. One of my friend recommended that I look at Short Term or Ultra Short term Corporate bond fund, because they gave better returns than a Liquid Fund with a slightly more risk.

I was evaluating if I should opt for this instead of Liquid Funds this year. Instead ILFS, DHFL ans Zee all defaulted on their debt sending multiple Debt funds down to dizzying depths - upto 50% down on a single day. This has scared the crap out of me. I have decided to revisit this category sometime later.

Buying bonds directly

Buying Corporate bonds which give 9, 10 even 11% interests have been an enticing thought for a while. But after the default episode and evaluating the amount of money I want to invest in a debt fund, I have decided against this completely.

- Buying Bonds directly only increases the overhead in terms of accounting for taxes.

- You always have to buy them in lots. So if you are a little short or in excess it is irritating.

- Buying bonds of a single company increases risk. Most funds only lost 5-10% when the defaults happened. If I had owned a bond instead of bond fund, it might be a complete 100%.

Maybe I will think about corporates bonds when I am dealing in Crores.

-

Equity Funds

5.1 ELSS Fund Consolidation

ELSS funds require the shortest lock-in period of all 80C Deductible investments. Salaried people might have other avenues to for taking advantage of the 1.5 Lakh deduction, for a freelancer, I find ELSS the best option. In 2016, I setup SIPs to 3 Mutual Funds because I wasn’t sure which one was better. So I went to MoneyControl.com sorted by returns for 1YR, 3YR and 5YR, and chose 3 names that came consistently in the top 10. This year, I compared the returns and cancelled the poorly performing 2 and setup another SIP to the better performing one for the combined amount.

Good Performance - Axis Long Term Equity Poor Performance - ICICI Pru Long Term & Franklin Templeton Tax Saver

Note: FreeFinCal says there is no real reason to use ELSS, because there are other ways in which you could deal with 80C deductions. Take a look

5.2 Index Funds

I wanted to invest in something other than ELSS and on my search to find a good Large Cap Equity Fund ended up with this in April.

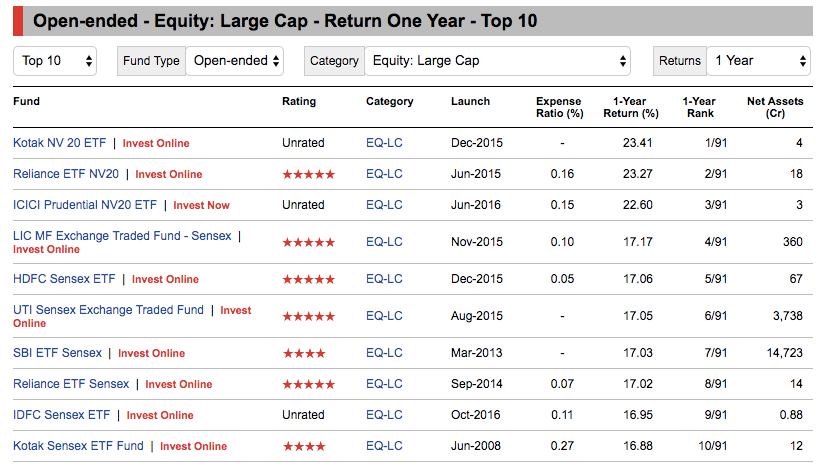

Around April 2019, all the top Large cap funds were Index Funds. Passive Investing is a big theme in US. As more and more managers struggle to beat the Benchmark indices it becomes a game of luck to invest in the right fund. My personal experience with ELSS is proof to that. Despite all three funds being in the top 10 of ELSS category 3 years ago, now only one remains there. This convinced me to setup SIPs in Nifty 50 Index Fund and in Nifty Next 50 Index Funds.

- Index funds despite being called as passive funds are actually actively managed in a way. The growing companies get added, the laggards are removed via Index Rebalancing twice every year.

- Index funds kind of puts the investing on an auto pilot. I don’t have to take stock of the returns and see if I am doing better than the Index and adjust.

- Point 2 is important because, if an active fund underperforms after 1 year, I have to redeem the units and switch it to a new fund. This would mean, I have to pay taxes on the gains.

Having said that, I think there are really good active funds out there focusing on a variety of themes, company sizes and industries which have been producing a lot more than the Index. It requires a bit of hunting and follow ups once every year.

-

Timing Investments

After I decided to invest in Index Funds, I started wondering if there is something that I can do optimise the timing of my purchases and increase the returns via Index ETFs. I did some analysis to use 50 Day Simple Moving Average to buy lower than average price … long story short, “Just do SIP”.

Here is the full Analysis: Investment Strategy: SIP vs SMA 50

If you are interested in other such optimisation strategies see this page on StockViz. Invariably every one of those will hold up SIP as the best strategy.

-

Annuity Plans by Insurance Companies

A friend got sucked into an Annuity plan in 2018 by SBI Life and another one was about to be last month by HDFC Life, hopefully the reader doesn’t.

Annuity plans are the ones which have a description something like this - Invest X amount with us for 5 - 10 years. We will then give back X for double the period 10-20 years or 2X for the same amount of years. There is usually a cool of period involved after the investment period when neither you pay the insurance company, nor they pay you. It also includes accidental Death cover.

Whenever some approaches you with such an investment plan, do one thing, run. I will actually go one step further:

Whenever an insurance company offers you an investment plan - Run

Here are the reasons why:

- If you apply the run of 72 and calculate the interest rate based on the annuity starting period, or do a IRR calculation using an Excel Sheet you will find that the interest rate they are offering you is less than Bank FD Rates. I am yet to see one annuity plan which does better than bank FD.

- The reason they are able to double the premium for the same number of years or the premium for double the number of years you invested is because your money would have doubled by the time they start paying back at 6% interest rate. (72/12 yrs = 6%) Almost all annuity plans will have 11-12 years as the cutoff after which they start paying you back.

- They gloss over the fact that 4.5% the first year and 2.5% every year will have to be paid extra as GST on the premiums. If you include that, the annuity returns wouldn’t even come to 6%.

- You can get better returns by buying Govt of India Bond at 7.4% or 6.9%

- You can do better by investing the money yourself in a Liquid Fund for the same number of years. You will have a bigger corpus including what would otherwise go as GST.

- If you stop anytime in the middle of the agreed period, you only get back what they call as surrender value which is I have see between 10-80% what you have invested. Yeah. They won’t even give your money back, forget doubling.

- The Life insurance they include is just a cover to sell this product and the insured amount won’t matter much and is usually a multiple of your premium. If you want life insurance, get a term insurance separately for a multiple of your annual salary, so your family’s requirement is actually taken care of.

- If you are really thinking in terms of 10-15 years, I think allocating a portion to Equity Fund is a smarter thing to do instead of falling for assured returns.

- If they claim returns are tax free, kindly remember, paying 40% tax on 12% gains still gives you 7.2% gains which is higher than 6% tax free.